Work comp: Permanent partial disability (PPD) lump-sum calculator

-

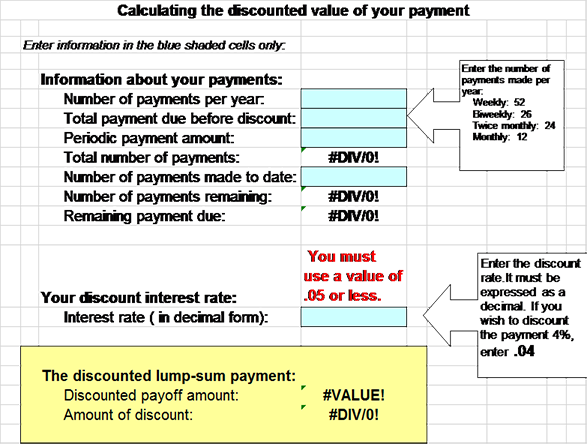

View the PPD lump-sum award calculator (Excel)

During the 2000 legislative session, Minnesota law (Minnesota Statutes 176.101, subp. 2b) was amended to permit the lump-sum payment of permanent partial disability (PPD) awards at the request of the claimant.

Effective Oct. 1, 2000, the lump-sum payment allowed is the present value of the PPD award using a discount rate up to 5 percent. The present value of a PPD award is calculated using information about the award (the total award, the size of a single payment and the frequency of payments) and the identified discount rate. Given this information, the lump-sum payment calculated is the amount the claimant would need to invest today at the identified interest rate to earn an amount equal to the PPD benefit flow.